Mitchell Nolan and Christian Horn have been in the home contracting business for years and they understand the needs of the customers as well as the struggles that contractors face. They know that to stay ahead of the game, they need to offer advanced solutions to their customers. That’s why they developed a platform that enables contractors to operate every aspect of their business in an advanced way, providing the best service possible. One of the key elements of their platform is offering financing options to customers. By leading with financing, Mitchells and Christian give their franchisees a winning advantage when talking with the customers. This makes it easier for contractors to offer solutions to their customers that are not only the best possible option but also affordable. Their platform is simple and easy to use, making the entire process more streamlined. This not only benefits the contractors but also the ultimate client by offering them multiple options to choose from. Customers are no longer just a target but a participant in the home improvement process. Through their platform, contractors can offer financing options that best suit their customer’s needs. This ensures that customers get the best possible solution without worrying about affordability. By enabling contractors to offer advanced solutions, Mitchells and Christian are changing how the home contracting business operates. Their focus on offering advanced solutions has not only made their franchisees successful but has also made their customers happy. By providing a better experience, contractors are able to establish long-lasting relationships with their clients. This ensures that they will be the go-to contractors for their clients whenever they need a job done.

—

Welcome to the show where we get the unique opportunity to level up and learn from industry leaders in franchising business and high-performance personal development. This episode goes without any exception. We have two all-star executives for a top finance and technology company. Welcome to the show, Christian Horn and Mitchell Nolan.

We are glad to be here. Thank you for having us on.

We are looking forward to this. This is going to be a good time.

Let’s get right into it. What does Operandi mean? What does it stand for? What do you guys do?

When you are looking at the name operandi, have you ever heard of MO or, “What’s your MO?” Have you ever heard of that phrase?

Yeah.

It’s like that. MO is Modus Operandi. The reason we got set on the name Operandi is it’s true to the core mission of what we are looking to do in our business, which is enabling home service contractors to operate every aspect of their business. They have a new operandi or a new mode of operation that is more advanced and allows them to do what they love and serve more customers.

What is your motive? I know personally as founder and an actual partner with you guys, one of the first things I thought was, “Operandi?” The name is very catchy. I oftentimes hear clients saying, “Why LIME Painting?” It takes a little while for LIME to sink in, but once it does, it clicks. I feel like your name, there’s a little bit of an art to it. I was curious. Are there any personal attachments or any underlining meaning to it? What does the name mean and how does it have an impact on conversations with clients?

The name means MO or Modus Operandi. It’s about enabling these contractors to operate their business in a new mode of operation that is more efficient and allows them to do what they love.

What an important calling and mission in your business, helping specifically and mainly home service companies. I’m making an assumption there. It brings tremendous value to its customers. How do you guys find that it is bringing value to franchise owners?

Bringing value to franchise owners is something that’s at the core of our business. We want to work very closely with those franchisees to ensure they have everything they need to succeed on the financing side and make sure that the consumer is financed. What we like to do is give them a game plan of how we like to offer financing to that customer so that customers can then get the best possible product, solution, a new HVAC unit in their home, or new paint on their house.

Do you find that franchise owners use your tool quite a bit?

Most definitely. What we like to do is have the franchisees lead with financing. Every single home that they come into, they lead and open with low monthly payments. That way, they always give the customer an option to finance that job if that customer wants to.

Many times, is this a hard solution for a franchise partner to have or is this something that’s easily accessible?

Yeah. One of the key things that boil down to our core as a company is everybody that who started the company comes from a home service background. I come from an electrician family. Mitch did landscaping. Our CEO did the roofing. Our COO did HVAC. The gentleman that is doing a lot of our marketing came from framing houses in college. We all came from that world of home services.

One of the things that we understood from that experience is that whatever solution is going to be added to a workflow needs to be simple and easy with no exceptions. The products that we have developed have come from that place of experience of that home service background. We are understanding the needs of contractors because that’s who we were and making the tools that are going to be easiest to use and drive the most value for the business.

A lot of times, technology companies, specifically a finance company, don’t necessarily have that hands-on direct experience that can differentiate a platform or a solution. Especially like this one, it sounds like there are some nuances. I would assume there are some nuances that make your product differentiated and bring a lot of value. I could see how a franchise owner immediately is going to benefit from growing their business. On the flip side of the coin, how does it help homeowners with using your platform?

It’s no secret that things are getting more expensive. Everything from the gas pump to the grocery store, everything is getting more expensive. When we see the expense increasing as well as the demand for quality home services that are harder to find, there becomes a gap between what that customer might be able to pay for in cash and what the price for what is going to be the best investment and best choice for them and their property.

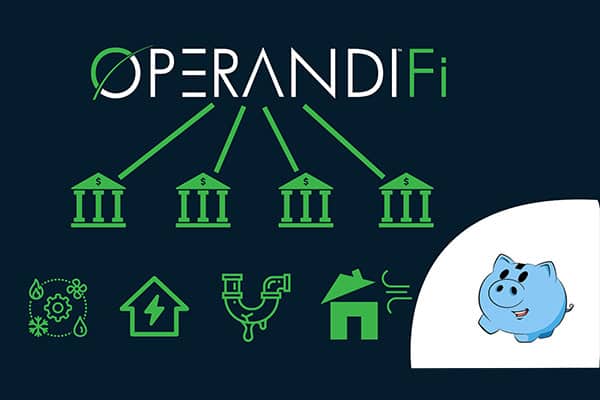

What we do is enable them to make low monthly payments for a solution that is going to last them a lot longer. It’s going to ultimately add more value to the home and give them an end product that they are a lot more satisfied with. We do that through our partnerships with over 400 lenders. All are competing to offer that customer the most competitive rates on every transaction. Instead of a single-point lender like Mitchell or I opening our wallets to look to make that loan along our lending guidelines. We take advantage of all the lenders out there. We allow them to focus on the specific loans they want to make and get customers the best and most competitive rates and most competitive options every time.

This allows the homeowner to be a participant in the process so that they can select the best possible loan option for them and inevitably get the best solution for their house.

If I’m a homeowner, I’m probably thinking, “This is going to be a laborious and long process.” There’s probably a lot of paperwork. I’m putting myself in the shoes of a homeowner. That’s my initial concern. I’m sure there are also concerns about having the financing to do the project in general. The option to have the financing solves that issue.

My next reservation is the one I was explaining. It’s like, “This seems like a lot of work, and granted, I’m getting finance and getting money a means to an end.” There is a little bit of a pause there. We are procrastinators and we want things to be easy. How do you help clients with the simplicity of your platform or your tool?

When we are looking at the position that a client in so often when they need home services of any kind, including painting, they are in a position where they want it to be easy and they want it to be done, and, most importantly, done right. It is so that they are not having to buy twice and have that redone a few months later when it’s all peeling off. The psychology of the sale fits dramatically when you are sitting down, offering options for that customer compared to telling them, “This is what you need to get. This is what you need to do,” as customers so often are.

One of the key things we focused heavily on in our process is bringing that customer into the sale not as a target but as a participant in the process where they are sitting down and choosing the rates and terms that are best for them. That alleviates the pressure from the representative of the home service company, allowing them to educate that customer on what’s going to be the best value for them in their property.

Being a partner and user of the tool, I have seen firsthand the ease with which our clients can go in and set filters. They don’t have to necessarily vet out a lot of different options and do multiple applications. What I love about the tool is that you guys immediately have qualified options competing for that client’s business based on the filters that they have set.

I have found that to remove so many barriers to a client saying yes. As a result, our franchise partners are able to bring more value to clients. Why? It is because that client has more capital, frankly. They can do more, get more solutions, and solve more of their problems. That’s been tremendous. I could be naive to this space but is that pretty unique or is that common?

In the development of Operandi back in 2019, that’s something we were looking to accomplish. That was making a streamlined application process so that the customer can go in and fill out all the information, and in 10 seconds, get those 400 lenders competing for their business. That’s very uncommon in the industry.

You have a lot of legacy finance companies out there that are opening up their war chest. They want to make sure that the money that they lend is to the correct homeowner that is able to make out that loan and pay it back. They do a lot more due diligence than the lenders on our platform in the sense that the lenders on our platform are looking at the debt-to-income ratio data and then the credit poll score.

How are you guys noticing that you are able to help franchise owners build their businesses?

When we are looking at the data, it is very clear that companies and franchise locations that are utilizing and leading with financing and monthly payments for their customers are, on average, closing a total of 30% more deals and increasing the value of those deals anywhere from 20% to 35%. Not only do you close more deals because you are overcoming that barrier of cost for the customer, but you are able to increase the purchasing power for that client making each sale more valuable.

With OperandiFi, we take it even a step further. We are working off the territories and franchising. Your potential clients are limited to those that can pay cash when you are in that business. By offering low monthly payments, you are able to make the most of your territory and access clients that may have otherwise been inaccessible that other companies and other painters wouldn’t have been able to access. We make that accessible giving you a great competitive advantage in the market.

It’s a win for all. When you are looking at the consumer or the homeowner, they are able to get the best product. It may be a slight upgrade from before because they are able to finance it. Also, the franchisee is increasing their ticket price and selling more or closing more. The franchisor wins as well because there is high revenue and more loyalties for the franchisor.

I can see the value. There are so many different checkboxes that are being hit from a client’s standpoint and a franchise owner’s standpoint. I love what you said about leading with a financing option. That’s an incredible stat there. What was the percentage?

On average, 30% more deals were getting closed. The value of those sales increases anywhere from 25% to 35%.

Clearly, that’s because that client, maybe they don’t finance the whole project but they commit to a certain aspect of the project or a certain percentage, and then they can finance the rest. Is that pretty common?

Yeah, for a lot of the projects that they do, they usually finance the whole project. If the consumer won to finance maybe a portion of it, that’s very doable. We see most of the time that they finance the whole thing.

In our world, a lot of our tickets are $20,000, $30,000, $40,000, or $50,000 at LIME. We are working for more custom high-end clients and offer 40 services. Granted, that’s not the norm, but our average ticket is $11,000. It is pretty common to have a $12,000 paint quote, $8,000 for the gutters, another $10,000 for the stamped concrete that wraps around the property, a couple more grand for all the metal, and a couple more grand for the doors. Before you know it, you are at $40,000 or $50,000.

Many times our clients do everything. They don’t do the paint or this aspect. There’s a convenience of doing everything. Leading with financing gives that client the option to pay for this project and that project upfront and possibly finance something that is still a pretty sizable ticket. It could be a $10,000 stamped concrete project. That in combination with a couple of thousand dollar projects, before you know, it is a $15,000 or $20,000 finance there. That franchise partner is able to bring a lot more value to that client. I appreciate you sharing that. What do you find to help franchise partners communicate about your tool more effectively?

We’d give a couple of tips on that. First is when you are sitting down with the customers, you see so often that there’s a stigma around needing financing or wanting to pay low monthly payments. It is by opening the conversation around that and saying, “Here is what we are looking to do for you. We are looking to get this painted, have these gutters put on, take care of the driveway stamping, and do these doors. With the cost of labor and cost of materials, the price for that is X. We also accept monthly payments, credit cards, checks, and cash.”

Making that another payment option for the customer gives a lot of value and opens up the opportunity for a lot of customers to do that. They may not have even known that that was an option. It gives them an opportunity to get more work done that they wouldn’t have necessarily done in the absence of that solution because they would have had to pay cash for it. The tip would be leading with that, making it part of the process, and integrating it with your software. Those would be some of my top tips for being able to raise those average tickets and close sales.

Another tip we like to say is, “Don’t say the F word.” The F word in this case is financing. Financing has a very negative connotation with that consumer or homeowner because they feel less of or less than for needing financing. We like to say low monthly payments. Low monthly payments engage them in that process and give them the option.

You are saying, “We have a low payment option,” versus, “We offer financing.”

That’s correct. Consumer fears less, not like a participant, when they hear financing. It is a point off in their heads.

What an interesting piece of information. In our world, we like to say, “We don’t want to tell clients they have problems. Much of our presentation is about presenting problems and implications.” Your stucco is cracked. Your stamped concrete is deteriorating. Your metal is oxidizing and rusting. Telling them that this is a problem and you have a problem. Here’s another problem. It is one of those isms that doesn’t pan out so well. Thanks for that. It seems so natural to lead with, “We have a financing option,” but the reality is you are getting that client to push back a little bit. I would assume that’s probably a pride thing.

We have seen this certainly with our clients in the franchise space and our customers. This is also information data that’s been very well-established from a sister industry. That could be your auto finance industry or your housing industry. You are looking at other types of services and products that are being sold where a lot of that is going on monthly payments. Some interesting data has come out around that. It’s showing that the term monthly payment is the magic verbiage for having those conversations and opening those discussions with the customer.

It is letting them know, “We have a monthly payment option as well,” right?

Yes, and presenting what that would be. When sitting down with the customer, it’s, “This is the work that we are looking to take care of for you here today. We will do 1, 2, 3, 4, and 5 to get this taken care of for you. We can do this at X dollars per month. If you prefer to pay cash or check, you can do that at this price.”

Something very interesting was a 2018 consumer report study that showed that there are two types of car buyers. There is one that looked at the price and one that looked at only the monthly payments. It was split half and half. Of the half that only looked at the monthly payments, there was half of them, so 25% to 30% of those people that when they looked at the monthly payments, they didn’t even look at the quarter price of the car.

You are having, in the car industry at least, about a quarter of the buyers of cars not looking at the total price. They are only focused on the monthly payment. When you can do that, you can provide that consumer or homeowner with the best possible solution for the house or their project at a monthly payment that they can afford.

In that monthly payment, what are the variables that make that monthly payment different for one customer versus another customer? Let’s say they are both $20,000 projects. One customer is paying a higher amount and another one is paying a lower amount. What are some of those factors that go into changing up that monthly payment?

There are three main factors. There’s the primary and most important factor, which is called DTI or Debt-To-Income ratio. That’s how much money you make versus the obligated debts you have. There’s a credit score, which is significantly less important than your debt-to-income ratio. There are then terms of the loan. What interest rate are we looking at? How long is this loan going to be? What project are we doing here? Those three variables working together determine what that customer is going to get qualified for and what’s going to be the best option for them.

You couldn’t necessarily flat-out across the board tell a client, “If you are at $10,000, here’s your monthly payment. If you are at $20,000, here’s your monthly payment.” You couldn’t create a chart and easily be able to reference it. Even as a salesperson, there is a rhythm of being able to advise a client on that. It sounds like there’s a little bit more to it. There are some variables that are going to create some variation in that monthly payment. Is that correct?

You are very close. When we are looking at the process for doing this, one of the key things that make us unique is that we have so many lenders competing on every transaction. When we are sitting down and presenting to that customer, we are giving them the most live and up-to-date rates. Instead of working off a piece of paper, we can run this customer through our system in a matter of 90 seconds.

We have a menu of dozens of options that are all up to date with the most competitive rates based on all those factors. The paper doesn’t quite make as much sense. Since we are not setting those rates and partnering with the lenders that do, it’s not something that we determine. That ensures that the customer’s always getting the best rates.

That’s a tremendous amount of value from the customer standpoint. There is a little bit more than that that goes into it. It’s not necessarily that straightforward. I hope anybody reading this is getting a tremendous amount of value and learning quite a bit. You can see how that experience from your team is translating into a solution that brings franchise partners value to build their businesses and homeowners tons of value to provide or receive more value. I’m curious. What got you into the positions that you are in? What are your journeys? What do you do for OperandiFi? What are your roles and how’d you get there?

I will start with me. When we are looking at the journey of getting into this. It was ultimately born out of a need in the industry for simplicity. Often, tools were being created by your traditional and typical software developers. They didn’t understand the problems that home service businesses of the country face. It was out of that need that it came to be that we had to do something. We built Operandi from that. I came from a career in private equity and payments and moved over to starting this company in 2019. I’m the chief financial officer and director of strategic initiatives.

That’s the private equity background. That’s awesome. Have you always been in Florida?

For the most part. I have had a fair amount of travel in my life and have enjoyed that. Florida is the place to be. Why would you want to live anywhere else?

Why would you? I have almost fallen into that trap. In your private equity background, was that in Florida?

That was traveling. We were doing crematoriums and software facilities for that project. We were rolling these up, buying them, and pulling them together into one conglomerate, and then looking to sell that off to a larger firm that ultimately took it public.

That is very interesting. Where was that company headquartered?

The company is based in Toronto.

In Canada?

Yes.

Mitchell?

Palm Beach Atlantic University is where I did my undergraduate at. When I was trying to find a school, I wanted to stay in Florida. I played golf and wanted to find a school I could play golf for a college team in Florida. I found PBA. I loved the coach and loved the atmosphere. I decided to come on down to PBA, and that’s where I met Christian and the Operandi team at the church that I started going to in Jupiter.

He was explaining to me what he was doing in critical processing and consumer financing with Operandi. I said, “Could that work in the franchise space? I’m studying franchising at Palm Beach Atlantic University at the Titus Center for Franchising. Could we bring that same model over the franchising where we have franchisees that are able to offer consumer financing to their consumers and their homeowners to give them the best possible solution?” From there, we got together. We are offering consumer financing to the franchisees.

What an innovative concept and truly becoming a top technology solution financing that very unique option within the franchising space. I know us at LIME, we are newer to the platform and learning it and adopting it. A tremendous amount of value and something that we are more excited about is we learn about it and continue to apply it. There is so much opportunity.

Christian, I love the stat you shared about leading with the payment options. Financing is a no-no. Start leaning toward payments. It’s critical. Congratulations. You guys have pulled together an incredible team, your leadership team. I always enjoy hanging out and learning from you all. It’s such a great cast of individuals. We are honored to be a partner with all of you.

You had mentioned something, Mitchell, which is the Titus Center for Franchising at Palm Beach Atlantic University. It has become a top program for franchising. It’s unique and innovative. If you talk about the thought leaders and individuals involved with the center, it’s incredible. When I learned about you going there, I was even more appreciative of who you guys are. I wanted to give you the opportunity to talk about the Titus Center for Franchising. What is it all about? What does the program do? Who’s involved with it?

The Titus Center for Franchising, their mission and goal is to educate the next generation of franchise executives. It was started back in 2017 when Ray Titus, the Founder, CEO, and President of United Franchise Group or UFG, set out and donated the money to start a school or a center for excellence for franchising. He did it right in his backyard at Palm Beach Atlantic University in West Palm Beach.

Dr. John Hayes is the chairman and the teacher or professor that teaches all the classes. Dr. Hayes has been in franchising for 40-plus years. He has written his very first book on franchising called Franchising: The Inside Story Back in the ‘80s. Dr. Hayes is a great leader and a great mentor of mine and Christian’s that have helped us in the franchising space.

Dr. Hayes is a big asset to all the students at PBA and all the students enrolled at the Titus Center. We have had about 40 graduates from the Titus Center. The graduates of the Titus Center own a concentration in franchising. As well with the 40 graduates, we have about 50 to 60 enrolled in the program. They are getting their concentration in franchising. I graduated in 2022. I’m working on my MBA in franchising. Red Boswell graduated in 2022 with his MBA in franchising. That’s what I’m walking on next.

Red was on the show. He is a talented individual and a thought leader with a creative mind in franchising. The Titus Center is building so much appreciation for franchising. It’s truly unique. There is a limited amount of programs from an academic standpoint that offer franchising education. It’s traditionally been through the International Franchise Association or consultants, mentors, and advisors. I’m going to consider that MBA. I’m a little bit of a book nerd from time to time. It’s the timepiece that it requires. I appreciate you sharing a little bit about that. I had no idea they offered an MBA. How neat is that?

A random fact, Dr. Hayes has a book called 12 Amazing Franchise Opportunities. It is one of the many books that he has authored. When I was starting my franchising career, we were one of those twelve amazing opportunities that he featured. I was very humbled by it. I first met him at the Javits Center in New York. It was a franchise conference. It was shortly after he had published us in his book. I was able to go on a show and get interviewed. That’s the first interview I have ever done. He is an amazing individual with a great heart and passion for franchising.

To know that you studied and are mentored by him, I have that much more appreciation for our partnership and your guys’ talent. I appreciate you guys sharing your story and a little bit more about the solution and how it brings value to customers and franchise owners. I figured there’d be no better way to wrap up than to talk about why you guys love the franchise model.

We were looking at small businesses in America. You know the failure rate. What’s the failure rate, Nick?

In start-up businesses as a whole?

Start-up and small businesses in the United States.

80% fail in their first 4 years. The reward for surviving those first 4 years is that in the next 4 years, 80% fail. From a start-up standpoint, it is a very competitive landscape. Consumers don’t care. If you are starting up without a playbook, a process, or a model to follow, you have to figure it out. That’s what makes that failure rate a reality. It is the pain and resources that go into competing and learning to build a model that’s competitive.

That’s right. We talked about this one of the first times we met. It was that failure rate being so high, not just for the first four years, but when you come to the end of that, there is even more failure. It is so difficult to go through that as a business. What I love about franchising is you get the expertise, the insight, and the playbook from people that have been there and done that so you don’t have to make the same mistakes.

The proof is in the pudding. No system has created more wealth and success for small business owners than franchising has. Seeing that success and the growth of allowing people to go in and pursue their dreams is so inspiring to me. I get amped up every time I talk with these franchisees and see them crushing it. I’m so glad to be a part of the community and to see that growth and development happen.

For me, the individuals in franchising are spectacular. Everybody you see at a conference, the individuals are top-notch people. Something I enjoy being around is individuals that care for their franchisees and care for the consumers that they affect. On top of that, there’s a wealth creation that exists between the franchisor and the franchisee. The franchisor creates these systems and allows these franchisees to buy into these systems. They are able to take an individual that doesn’t know anything about painting or doesn’t know anything about the roofing industry. They allow them to be an expert in that industry with these systems and create a business that will provide wealth for their family and create a life-long dream of theirs.

That is well said. One thing that I have appreciated about being a partner of OperandiFi is that you guys take that to heart. One of the focuses for us, when we partner with anybody, is whether they are capable of supporting our owners and properly onboarding them. It’s more than having access to franchise owners to do business with.

That onboarding process and the ongoing support are so important in being a franchise partner because every business owner is that, an independent business owner with individual questions, concerns, and needs. I appreciated that with the way that you guys go about supporting us. If you wouldn’t mind sharing with our readers, if anybody is interested in getting ahold of you and learning more, how can they do that?

They can go to OperandiFi.com. From there, they can get some more information about our solution, technology, and products as well as contact us and get their business into gear.

I appreciate you two sharing your knowledge and expertise in this space, helping our audience level up. Thank you for being on the show.

Thanks so much for having us. We appreciate it.

Thank you. We appreciate it.

If you are reading and you like this episode, please like it. More importantly, contribute to the conversation. Maybe you have some questions. If you are interested in how to better present or understand different aspects of the platform or you are genuinely appreciative of individuals that are bringing a lot of value, please contribute to the conversation. If you are interested in continuing to follow along with the show, please subscribe. As always, level up.

Mitchell Nolan is a professional in the world of franchising. With his company, DJM Nolan, Mitchell provides invaluable guidance and strategic insights to guide companies towards exponential growth and success. He is dedicated to empowering businesses to make informed decisions that lead to unparalleled achievements in the dynamic world of franchising. Mitchell Nolan is committed to making a positive impact in the franchising industry and helping businesses thrive.

Christian Horn is known for his exceptional talent in developing unconventional solutions for complex problems, Christian has earned a reputation for driving continuous improvement and delivering unmatched consumer value. With a proven track record of success in tactical business development, Christian is an accomplished professional committed to delivering organizational success. In short, Christian Horn is a true leader, one who is never afraid to challenge the status quo in his pursuit of excellence.